[ad_1]

As a story, Airbnb (NASDAQ:ABNB) – which makes a speciality of offering a web based market for brief and long-term homestays – weaves an excellent story. Primarily, the corporate caught the eye of buyers by leveraging unused house in a capitalistic endeavor, thereby legitimately unlocking worth. Nevertheless, an absence of a definite enterprise providing and the fading “revenge journey” phenomenon are two points which will harm the corporate. Subsequently, I’m bearish on ABNB inventory.

A Robust Q3 Print Solely Tells A part of the Story of ABNB Inventory

At first look, Airbnb may appear to be a beautiful alternative. Whereas ABNB inventory has gained over 44% for the reason that begin of the 12 months, within the trailing half-year interval, it slipped greater than 2%. Thus, on a relative foundation, it seems undervalued. Additionally, the corporate posted sturdy outcomes for its third-quarter earnings. Nevertheless, that solely instructed a part of the story.

At a fast look, Airbnb posted earnings per share of $6.63. This determine handily beat the consensus goal of $2.12 per share. Moreover, Airbnb rang up gross sales of $3.4 billion, beating the consensus of $3.37 billion.

Including to the strong outcomes, Complete Nights and Experiences Bookings landed at 113.2 million in Q3. Within the year-ago interval, this stat got here in at 99.7 million. As nicely, the sharing economic system specialist beat the consensus view of 112.9 million.

Nevertheless, administration expects This fall income to achieve between $2.13 billion and $2.17 billion. Sadly, this forecast slipped a bit below the $2.18 billion that analysts anticipated. It seems that key catalysts for ABNB inventory are dropping steam. Much more worrying, that’s not a far-fetched speculative argument.

In October, Airbnb Founder and CEO Brian Chesky admitted issues about low bookings and their earnings throughout a Bloomberg interview. “We have to get our home so as. We want to verify the listings are nice, we’re offering nice customer support and we’re reasonably priced. And I’ve instructed our staff that we will get again to creating new and thrilling issues as soon as we’ve fastened that basis.”

Shifting forward, although, the problem is that not all of Airbnb’s headwinds are immediately addressable.

Diminished Revenge Journey May Influence Airbnb’s Core Enterprise

Through the worst of the COVID-19 pandemic, the idea of retail revenge materialized. Principally, customers sought retail remedy, and it had a large impression, with e-commerce representing 16.5% of all retail transactions in Q2 2020. Later, the journey equal soaked up huge swathes of client {dollars}. Sadly, all good issues should come to an finish.

For ABNB inventory, the revenge journey phenomenon must speed up, not wane. Because the CEO admitted and because the firm’s This fall forecast revealed, trade knowledge factors to decelerating journey demand. Tragically, the Hamas assault on Israel, together with Russia’s ongoing invasion of Ukraine – to not point out different geopolitical flashpoints and tensions – don’t assist issues.

By pure numbers, for each main battle that emerges, that leaves fewer areas which individuals might journey. Furthermore, financial headwinds corresponding to excessive inflation and concurrently excessive borrowing prices crimp client sentiment. Subsequently, airliners arguably face severe issues. By logical deduction, if fewer persons are flying, much less demand exists for lodging companies.

As well as, company layoffs are nonetheless occurring due to lowered spending broadly. That will stymie discretionary spending, which in flip might harm ABNB inventory.

First Mover, Not Solely Mover

Beforehand, some analysts have made the purpose about Airbnb making a sensible monopoly within the short-term rental house. Actually, the corporate carries the first-mover benefit of monetizing particular person owners’ unused house. Nevertheless, as different firms catch wind of the idea, ABNB inventory will virtually invariably endure from stiff competitors.

That’s particularly worrisome if Airbnb leases march towards parity with their resort equivalents. The latter affords closely regulated professionalism and protocol standardization; the previous merely doesn’t. If value parity turns into a actuality, ABNB inventory dangers dropping relevance.

Is ABNB Inventory a Purchase, In response to Analysts?

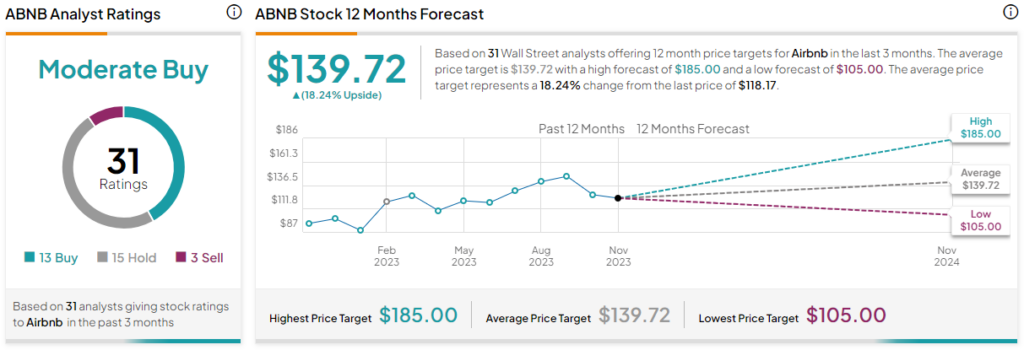

Turning to Wall Avenue, ABNB inventory has a Average Purchase consensus score based mostly on 13 buys, 15 Holds, and three Promote rankings. The common ABNB inventory value goal is $139.72, implying 18.2% upside potential.

The Takeaway: Learn the Indicators About ABNB Inventory

Whereas Airbnb deserves respect for figuring out a enterprise alternative and thus unlocking billions of {dollars} of hidden worth, the realities of the post-pandemic economic system could also be catching as much as the enterprise. Buyers solely must learn the indicators of travel-related headwinds together with the corporate’s personal broadcasted anxieties. Subsequently, a cautious method to ABNB inventory could also be prudent.

[ad_2]