[ad_1]

This has change into a fairly lengthy and someway rambling submit. In case you search for “actionable funding recommendation”, then you definately don’t must learn this.

Background: Handelsbankon on the weblog since 2015

One of many nice issues of an Funding Weblog/Journal is that one can simply revisit all the things that one has written years in the past once I wish to take a look at a inventory once more.

Handelsbanken is a inventory that I’ve coated very often since 2015. Initially, I in contrast Handelsbanken to Deutsche Financial institution in 2015, claiming that Handelsbanken is a significantly better run “high quality financial institution” in comparison with Deutsche Financial institution and that Deutsche Financial institution, regardless of the less expensive valuation, more than likely the more severe funding. That is how Handelsbanken has carried out towards Deutsch Financial institution and the European Banking index.

The excellent news is that certainly, Handelsbanken has outperformed Deutsche Financial institution by a large margin (in EUR) and till very lately, additionally the European Banking index. And this even if Handelsbanken was valued at round 17x Earnings and 2x P/P vs a P/E of seven and P/B of 0,5 at Deutsche Financial institution. The relative efficiency will be simply explaned: Deutsche Financial institution made losses in 4 out of the previous 8 years and earned cummulatve round zero EUR whereas Handelsbanken was worthwhile yearly, elevated EPS by ~40%.

That is what I wrote again then and nonetheless appears to carry:

“Shopping for low-cost” with banks is generally not an excellent thought as shareholders usually get massively diluted by means of regulatory required capital will increase. Paying for high quality in the long term is perhaps the higher and safer possibility.”

Studying 1: On this specific case and in lots of others, for financials, high quality is extra necessary over the mid- to long term than valuation. Particularly low high quality monetary corporations are nearly by no means good long- to mid time period investments.

Possibly Deutsche Financial institution was too low of a hurdle ? Swedish Friends:

Nevertheless, in comparison with its Swedish friends, Handelsbanken underperfomed, particularly since 2019

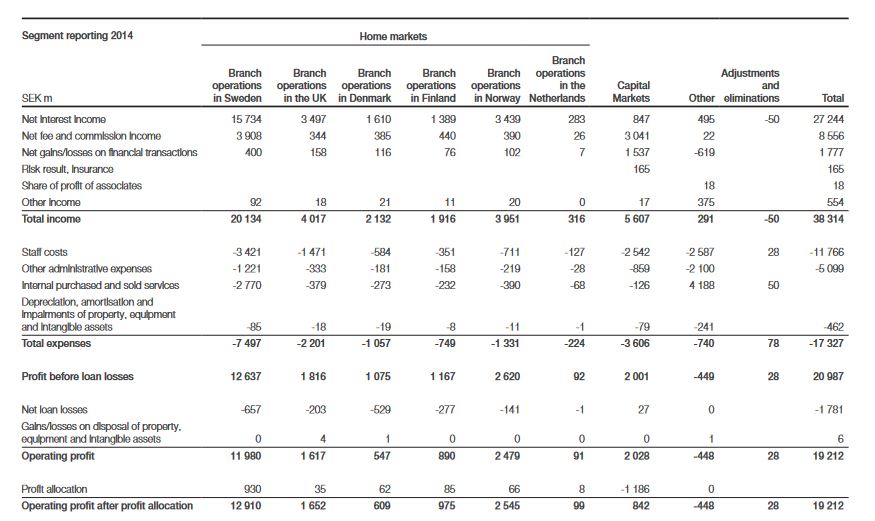

This was pushed in my view by 2 fundamental components: Handelsbanken’s beginning valuation was larger (17x P/E vs. 13-14) and revenue development was decrease. Really, Handelsbanken on an combination stage had declining income in 2019 and 2020 and solely from 2021 on, income began to extend. A deeper seems exhibits that the house market Sweden and even UK labored fairly effectively between 2014 and 2022. The issue appears to be extra the remainder of the Nordics and capital markets:

So wanting on the Phase reporting exhibits that Sweden has grown properly with greater than 55% over these 8 years and UK has greater than doubled regardless of Brexit and so forth. One other vivid spot has been Netherlands however they’re nonetheless small. Alternatively, Norway, the second largest market in 2014 has stagnated and Finland and Denmark have mainly disappeared. Each nation operations have been put underneath “discontinued operations” with a barely destructive total end result. Denmark has been bought in 2022, the sale of the End operations appears to have been signed on Might thirty first for round 1,3 bn EUR, barely above e-book worth. Handelsbanken pulled out of Germany and Asia already in 2019.

The massive query now could be if that restucturing was adequate to as soon as once more achieve a lead vs. its rivals, however the problmes clearly clarify why Handelsbanken now solely trades in step with competitrs Swedbank and SEB.

Studying 2: Even a top quality firm can have intervals of operational underperformance. The massive query is that if they will come to greatness after that.

Studying 3: In case you pay a premium for a corporation compared to its friends, this premium can disappear fairly rapidly.

One good instance for coming again is clearly American Categorical, one instance for coninuous porblems is Wells Fargo.

General efficiency since 2015 clearly sucks

The general dangerous information is that even Handelsbanken, earlier than dividends, trades decrease than 8 years in the past.

If I’m not mistaken, Handelsbanken paid out 38 SEK of dividends from 2016-2023, so the entire return is barely constructive. That is the results of a large mutliple compression for Handelsbanken from 17x earnings again then to ~8x proper now. On prime of that, in EUR, the Swedish Krona declined round -24% towards the Euro, making issues even worse for a EUR based mostly investor.

Studying 4: Even in the event you decide the perfect firm, in absolute phrases the efficiency can suck due to structural issues within the sector which often leads to a declining P/E a number of.

Studying 5: Don’t underestimate foreign money danger. -24% over 8 years towards the EUR was probably not foreseeable in my opinon. Regardless of the dangerous repute, the EUR is a comparatively robust foreign money.

Studying 6: A superb dividend can shield the draw back, however doesn’t assure you a good constructive return

My very own funding into Handelsbanken

My very own funding historical past is that I purchased a stake in Handelsbanken in January 2016 at a barely decrease valuation than in and then bought it in mid 2020 at a small loss (-6% incl. dividends) to deal with higher “relative” worth which turned out to be choice. My portfolio made about +40% total in the identical time interval.

Is Handelsbanken funding proper now ?

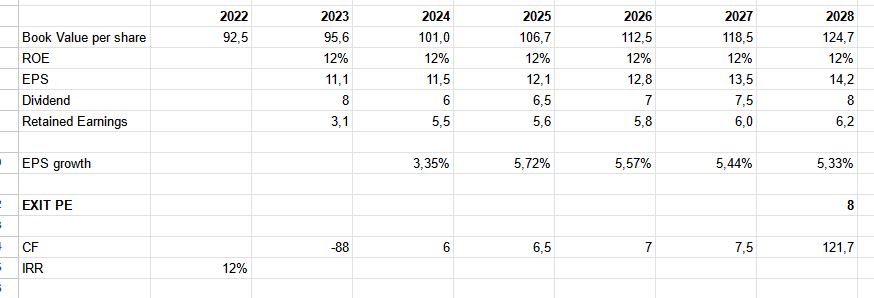

Now it’s time to revisit my simplistic valuation mannequin that I used for my funding choice which I had lined out on this submit. My primary assumption was that Handelsbanken acheives an ROE of 15%, can reinvest 25% of its revenue yearly at that price and will get an “secure exit a number of” of 14x earnings.

Clearly, my assumptions have been a lot too optimistic. Nevertheless, the query is clearly if Handelsbanken may eb funding now, at the a lot lowered valuation and with none “high quality premium” in comparison with its friends.

Primarily based on comparatively conservative assumtption (12% ROE, 8x exit PE), one will get, not surprisingly, 12% return p.a. pre tax which I’d contemplate as (a lot) too low contemplating the danger profile. Now we will mess around a liittle bit with assumptions. Assuming an Exit P/E of 10x, which might be on the low finish of the historic vary, the anticipated IRR would enhance to 17% over 5 years. That sounds extra attention-grabbing. Nevertheless, and that may be a massive HOWEVER, the scenario within the Nordis and especiall in Sweden is kind of troublesome, particularly in the actual property sector.

The approaching Swedish Actual Property disaster ?

Sweden has been having fun with just a few good a long time since their final massive actual property disaster. The poster baby for this can be a firm known as SBB that has misplaced round -60% because the starting of the yr. The FT calls Sweden the “canary within the coal mine”. The ten yr Govie rates of interest have been going up from barely destructive to round 2,3% on the time of writing, about the identical stage as in Germany in EUR.

Sweden has comparatively excessive LTV mortgage ratio in accordance with some sources (>60%) , nevertheless Swedish mortgages are “full recourse”, meaning the borrower can not simply stroll away like in some US states. Inflation was ~8% in 2022 vs. ~9% in Europe, salaries solely elevated round 3%, so shoppers are equally strained.

If we glance again to the GFC, Earnings for Handelsbanken fell by 1/3 from the height in 2007 and it took a number of years to regain that stage.

What now wtih Handelsbanken ?

To this point issues look good and Handelbanken reported superb Q1 2023 numbers, with ROE reaching 15% for the primary time in a number of years. Alternatively, an actual actual property cycle will take a few years to play out if we get one.

Handelsbanken is legendary for lending cash solely to individuals who don’t really need it and has the bottom default ratios, however an actual actual property disaster will clearly be a take a look at. So far as I may see, Handelsbanken has largely publicity to residential mortgages and little or no publicity to business actual property.

Handelsbanken used to at all times come out forward of disaster and the sale of the underperfoming companies appears to be fairly effectively timed. However nonetheless, I believe on this case, there’s clearly a cause why Handelsbanken is affordable and actually, I shouldn’t have a special view if and the way deep a Swedish actual property disaster may seem like.

Therfore, I’ll proceed watching Handelsbanken, however I’ll keep on the sidelines despit the very low-cost valuation.

Abstract:

There are numerous learnings within the Handelbanken case, however I believe a very powerful one is the next two:

- In the long term, it pays to stay with prime quality banks/financials, because the low high quality gamers regularily run into issues

- Nevertheless, paying a comparatively giant premium for prime High quality financials won’t be superb recommendation, as I skilled right here with Handelbanken, but in addition with Admiral. Ideally you purchase the prime quality enterprise throughout a down cycle with out paying further for high quality. In a down cycle all of the gamers get often hammered and inevstors don’t appear to distinguish a lot.

My feeling is nevertheless, that for Handelbanken, we’re not actually within the down cycle for Swedish banks but. I believe I’ll revisit the scenario by the top of the yr to see how issues have turned out by then.

[ad_2]