[ad_1]

Banks are on the coronary heart of contemporary economies, offering the liquidity wanted to run easily. They’re additionally constant revenue turbines, which implies investor consideration retains coming again to the very best banking shares and ETFs

Banks are additionally liable to seemingly random panic and crashes. This may be each a threat and a possibility to purchase high quality belongings on a dime. That is very true when main macroeconomic modifications occur, like a warfare or a fast change in rates of interest.

Early 2023 noticed a new banking disaster, with a number of regional US banks going bust. This doesn’t imply your entire sector is in danger, and among the greatest banking shares may even be on a reduction because of that panic.

The Finest Financial institution Shares

Financial institution shares are very numerous, from specialised companies to massive conglomerates. Their profile can vary from distressed belongings to dominant gamers rapidly swallowing smaller opponents.

We’ll attempt to supply a various view of the sector and concentrate on a number of of the very best banking shares, however we gained’t even come near overlaying all of the presumably engaging shares.

This record of the very best banking shares is designed as an introduction; if one thing catches your eye, you’ll wish to do further analysis!

1. JPMorgan Chase & Co. (JPM)

| Market Cap | $449B |

| P/E | 9.95 |

| Dividend Yield | 2.59% |

Our first choose on the record of the very best banking shares is JP Morgan, as it’s lively in nearly any phase a financial institution might be working in, together with asset administration, business banking, funding banking, funds, non-public banking, and wealth administration.

JP Morgan has grown loads in the previous couple of years, together with rising its market share of whole US retail deposits from 7.1% in 2012 to 10.9% in 2022 and reaching 22.4% of bank card gross sales whereas managing $4T of shopper belongings.

JP Morgan can also be investing massively in know-how, with whole know-how investments of $7.2B in 2023, of which $1B is in digital, knowledge, and AI.

As a result of its measurement, JP Morgan is without doubt one of the greatest banking shares for buyers who’re on the lookout for publicity to the banking sector however are cautious of taking dangers. The financial institution has strengthened its steadiness sheet considerably since 2019, including $800B in internet deposits and $600B in liquidity sources.

US regional financial institution hassle is perhaps a great factor for JP Morgan, which has just lately absorbed troubled First Republic Financial institution, resulting in document earnings. The robust influx of deposits is equally possible as a consequence of financial institution shoppers on the lookout for security.

With a Q2 2023 dividend payout of $2.9B and $1.8B in share repurchases, JP Morgan is concentrated on delivering worth to its shareholders, both by means of progress or revenue distribution. This makes a great banking inventory for cautious buyers on the lookout for a long-term holding.

💸 Study extra: The dynamic between know-how and the way we handle cash is ever-changing; our newest publish delves into this transformation.

2. Citigroup Inc. (C)

| Market Cap | $84.9B |

| P/E | 6.99 |

| Dividend Yield | 4.62% |

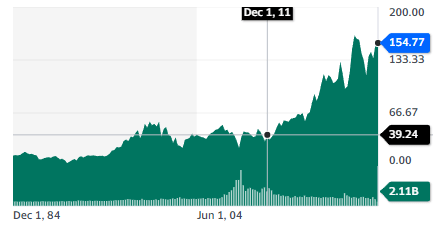

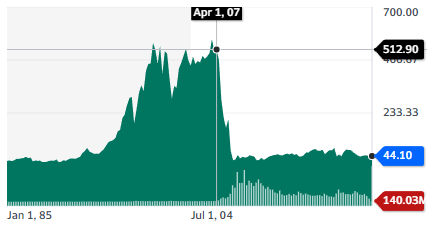

As a result of the banking sector is marked by crises, it’s value checking on firms which have made the headlines in earlier crises. Citigroup was on the core of the 2008 banking disaster, with its inventory dropping dramatically and getting $306B of presidency help.

Since then, the inventory value has not likely gone wherever. However Citigroup is now extremely worthwhile and buying and selling at a really low P/E ratio whereas distributing a reasonably giant dividend.

And Citigroup additionally appears to have realized from its extra troubled days in 2008, when dangerous subprime loans nearly took it below. In 2023, Citigroup noticed its belongings develop by 2%, and its deposit ranges and mortgage progress stayed regular.

The corporate is refocusing its exercise on the US and the Americas and is progressively closing and/or promoting its actions in China, Russia, Poland, and Korea.

Whereas bigger opponents like JP Morgan or Financial institution of America are targeted on progress, Citigroup is a reasonably “boring” banking inventory, not taking dangers like within the outdated days, and never rising rapidly.

This additionally appears already priced in, and it could possibly make for a great revenue inventory whereas its shareholders can wait (most likely a number of years) for a repricing to replicate the safer profile and slowly therapeutic popularity of the corporate.

3. ING Groep N.V. (ING)

| Market Cap | $51.5B |

| P/E | 9.53 |

| Dividend Yield | 4.19% |

ING is a world financial institution with actions in 40 nations, using 60,000 individuals and serving 37 million clients. It’s the market chief within the Netherlands, Belgium, and Luxembourg and has a robust presence in Germany, Italy, Spain, and Australia.

The corporate has steadily grown its revenue and internet ends in the final quarter, utterly ignoring any US turmoil. Simply in Q2 2023, it added 227,000 clients and grew whole revenue by 23% year-to-year. In the long term, the corporate plans to develop whole revenue by 4-5 % CAGR.

The corporate’s return on fairness is 11.7%. ING has a excessive stage of cell clients, with 60% utilizing the cell app not less than as soon as within the final quarter. The corporate’s progress on digital can also be exhibiting, with 63% of recent clients within the Netherlands approaching board digitally.

ING is worthwhile, has developed superior digital banking options, and is rising aggressively in new markets past its Benelux core area. This diversification gives some security and in addition makes it among the best banking shares for US buyers on the lookout for worldwide publicity within the banking sector.

The fairly average P/E ratio and comparatively excessive dividend yield additionally make it a great choose for a banking inventory, delivering worth, progress, and revenue concurrently.

📊 Study extra: Seeking to make clear the distinction between Worth vs Progress investing methods? Our new publish has you coated.

4. HSBC Holdings plc (HSBC)

| Market Cap | $157.2B |

| P/E | 7.1 |

| Dividend Yield | 6.36% |

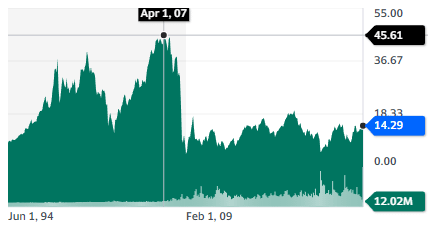

HSBC is a financial institution with an extended historical past since its founding in Hong Kong in 1865. It’s now lively in 62 nations and serves 39 million individuals.

Its core exercise is in Asia, and this shall be much more true sooner or later, with an ongoing strategic repositioning. HSBC plans to promote its French, Canadian, Russian, Greek, New Zealand, and Oman operations to refocus on Asia, together with India. This repositioning matches the circulation of recent belongings within the financial institution, now largely coming from Asia.

HSBC is much less retail-focused and extra centered round business banking and wealth administration.

Past the recentering on Asia and its dynamic economies and industries, HSBC can also be very lively in ESG investing (Financial/Social/Governance), with $255.5B of cumulative investments within the sector. HSBC can also be the world’s largest underwriter of GSSS bonds (Inexperienced, social, sustainability, and sustainability-linked) whereas additionally having room to develop from its present 4.4% market share.

One potential threat for HSBC is the Chinese language actual property market, which is present process a long-lasting disaster after a long time of increase. HSBC’s publicity is $14.3B, down by $2.5B because the finish of 2022. So, whereas not insignificant, this could not in itself be a systemic threat for HSBC. One other threat to look out for is the escalating US-China tensions.

The financial institution’s inventory has considerably recovered from its pandemic low however nonetheless trades at a low P/E and excessive dividend yield. It is without doubt one of the greatest banking shares for buyers who wish to catch Asia’s rebound in industrial and business exercise.

Additionally it is extremely weak to any disruption within the Chinese language and Hong Kong economies, so buyers in HSBC will wish to fastidiously assess dangers within the area, each financial and geopolitical.

5. Nu Holdings Ltd. (NU)

| Market Cap | $37.2B |

| P/E | – N/A |

| Dividend Yield | – N/A |

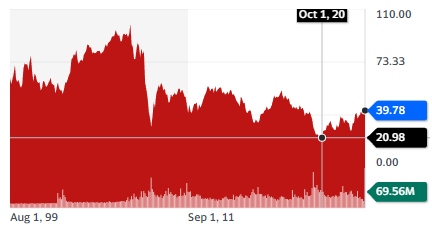

Not all banks are working in developed economies. One of the vital dynamic areas for banking is Latin America, the place a largely unbanked inhabitants is now becoming a member of the worldwide financial system, utilizing smartphones as an alternative of financial institution branches or computer systems.

Nu Financial institution has greater than 85 million clients in Brazil, Mexico, and Colombia. Its digital-first method is extra akin to the one you might count on from a startup reasonably than a financial institution. So is the explosive progress it displayed within the final 4 years and its 37% year-to-year progress in April 2023.

On all metrics, the corporate progress is astonishing, with buyer progress at a 46% CAGR and each income and gross revenue rising at a CAGR of over 100%.

The corporate’s progress may decelerate in Brazil, the place it already reached 46% of the grownup inhabitants (171M individuals). However it has loads of area to develop in Mexico and Colombia, with a 2% market share of a mixed inhabitants of 136 million individuals.

Inside Latin America, a area of 660 million individuals, NuBank has a whole lot of room left to develop, each in its current market and the area as a complete. Now that the enterprise mannequin has been demonstrated, it may be expanded rapidly.

It’s uncommon for a banking inventory to supply a double or triple-digit progress fee. NuBank’s success may even be closely pushed by the financial success of the area the place it operates. In flip, that is prone to rely on political stability and international costs for commodities, in addition to the area’s industrialization. So, buyers will wish to control all these elements earlier than shopping for Nu Financial institution inventory.

Finest Banking ETFs

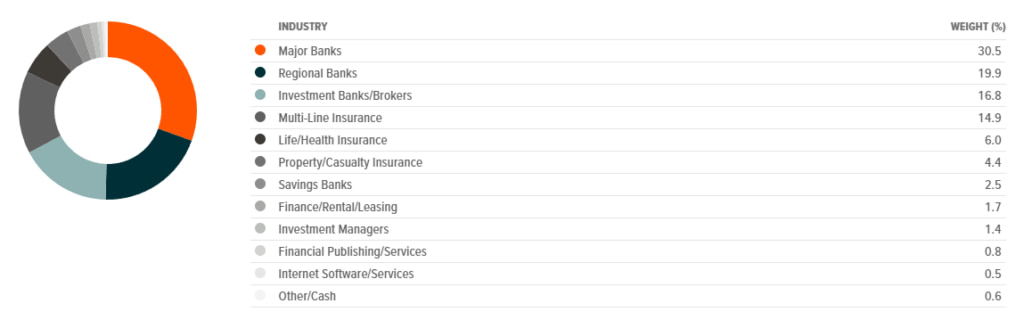

On the subject of figuring out the very best banking shares, it’s typically difficult to judge the standard of a financial institution’s steadiness sheet straight. To mitigate this uncertainty and diversify your publicity to the sector, contemplating ETFs generally is a strategic transfer, as additionally they assist in lowering buying and selling prices.

1. Invesco KBW Financial institution ETF (KBWB)

This ETF invests in all the key banking US firms, with its prime 5 holdings being JP Morgan, Financial institution of America, Wells Fargo, Morgan Stanley, and Goldman Sachs, combining for 38.7% of the entire ETF.

2. SPDR® S&P® Regional Banking ETF (KRE)

This fund makes a speciality of US regional banks, the sector that has been the middle of controversy and panic within the first half of 2023. This makes it a great funding car for buyers seeking to wager the disaster is over, and the inventory costs of those banks will rebound. The ETF is very diversified, with no inventory accounting for greater than 2.5% of the entire ETF.

3. iShares MSCI World Financials Sector ESG UCITS ETF (WFNS)

This ETF covers the worldwide banking sector whereas additionally together with insurance coverage teams (AXA, Allianz) and international monetary companies (Moodys, American Categorical). This makes this ETF a great proxy for the world financial system, globalization, and the financialization of the worldwide financial system.

4. MSCI China Financials ETF (CHIX)

This ETF gives publicity to the Chinese language monetary sector, with a concentrate on giant banks and regional banks, but in addition overlaying insurance coverage, brokers, and repair suppliers. It may be a great choose for buyers on the lookout for publicity to the Chinese language financial system or uncertain concerning the US banking sector.

Conclusion On The Finest Banking Shares

Banks are sometimes mentioned to rule the world, and it typically pays to be one in all their shareholders. That is nonetheless not a monolithic sector. There are a number of choices accessible: giant rising banks probably turning into nationwide oligopolies, troubled regional lenders, worldwide banks increasing overseas, or neobanks with a concentrate on digital providers and the unbanked inhabitants of the creating world.

When contemplating the very best banking shares to put money into, you’ll have to pay particular consideration to the steadiness sheet, as rising charges can dramatically scale back the worth of bonds held by the financial institution.

On the similar time, the teachings of 2008 have been properly realized, and each banks and regulators are taking a way more cautious and proactive method. So, after a short-lived turmoil and concern of a repeat of the Nice Monetary Disaster, perhaps it’s time to wager on banks to remain round and switch good-looking earnings for his or her shareholders.

In any case, diversification and cautious evaluation of particular person firms or ETFs is all the time fascinating.

[ad_2]