[ad_1]

Your finances is an attractive factor—your whole passions and priorities lined up in entrance of you, ready to do precisely what you inform them to do in help of the life you wish to dwell. You get to resolve manage your classes with a finances structured simply the best way you prefer it. *Chef’s kiss.*

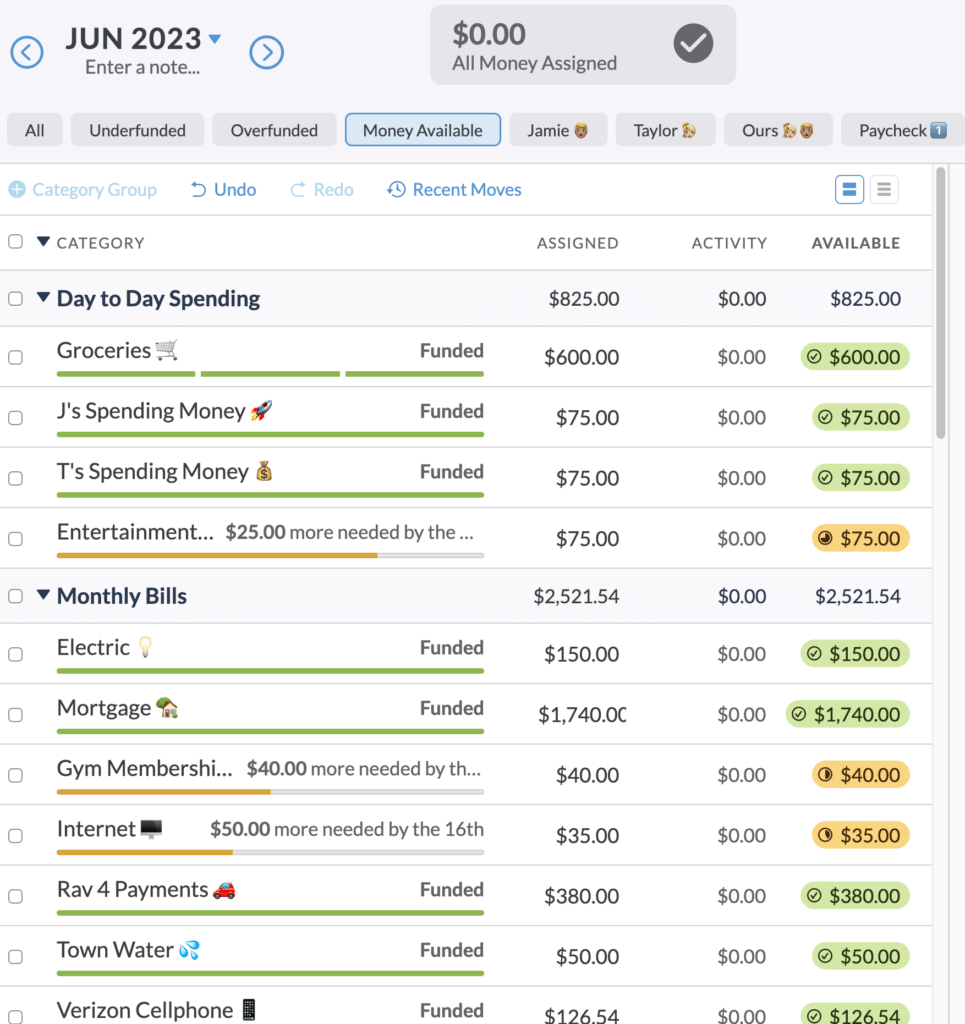

Once you’re on a mission to seek out out issues like, “How a lot did I spend—or overspend—on house items this month?” or “How a lot have I saved towards summer time trip?” you don’t want or wish to see each single class. Relying on what you’re doing in your finances, you might solely want to see a couple of.

Simply name us Genie—your want is our command! We’re excited to introduce you to YNAB’s new Targeted Views characteristic.

Targeted Views

Targeted Views mean you can see a subset of your classes relying on what you (or your associate!) wish to be taught, analyze, or evaluation.

You don’t open your finances for a similar cause each time. Typically you’ve bought work to do, like while you’re paid and people {dollars} want jobs, or while you’ve bought slightly overspending to take care of.

Different occasions you simply have to see completely different info differently that will help you with a call. Perhaps you’re attempting to dig in slightly deeper to spending patterns to tell a giant life resolution or fund an thrilling new chapter. (Simply ask Hannah what that’s like!) Targeted Views allow you to zoom in on the classes that matter to you most within the second.

Find out how to Use Targeted Views on Internet

You’ll see Targeted Views on the very high of your finances on Internet. (Concern not: cellular is on the best way!) Simply click on on a view to allow, and voila, it seems. Click on All to get again to your full finances class view.

There are numerous several types of Targeted views and intelligent methods you should utilize them to your benefit. Let’s dive in!

Preset Views: Let Us Do the Heavy Lifting for You

There are 4 Preset Views that allow you to examine particular areas of your finances. These are primarily based on the state of your classes, like so:

Overspending View

You’ll solely see this one when there’s overspending in your finances. No have to warn you if there’s nothing to deal with, in spite of everything.

Use this view to see the place overspending struck. Once you discover it, keep in mind to ditch the guilt and Roll With the Punches! Merely transfer cash from one other class and carry on keepin’ on.

Underfunded and Overfunded View

Bought class Targets? Have we bought some views for you! Typically your classes want extra money, and generally they find yourself slightly overstuffed.

The Overfunded View helps you “look by way of the sofa cushions” of your finances. When you want to cowl overspending, it’s a good suggestion to hunt for further cash! Now only one click on, and there they’re! You may be pleasantly shocked by the additional {dollars} you’ve got tucked away.

Consider the Underfunded View as your Payday View. Click on Underfunded to see the classes which are nonetheless on the lookout for {dollars} to affix the enjoyable. Concentrate on what’s left to fund the following time cash rolls in.

Cash Out there View

Click on on Cash Out there, and we’ll solely present you the classes which are partially or absolutely funded.

This view is useful for these moments when you want to make a spending resolution with out all of the noise, like when you’ve got a kitchen gear disaster and Amazon has simply what you want, otherwise you and your associate may actually use a Thirsty Thursday date evening after a busy week of parenting.

Customized Views: Zoom In On What Issues to You

Look, we are able to’t know all the pieces that’s vital to you in your finances. Perhaps you’re saving up for motorless boat components to deal with the R2AK. Or a luxurious retreat the place all you do is go to the spa and take naps. Budgets are like snowflakes in spite of everything—no two are the identical.

Solely you’ll be able to decide your priorities and the way you need your cash to be just right for you. We wish to be sure to can customise views to your coronary heart’s content material.

You’ll be able to create Customized Views that include a subset of classes that YOU choose. Think about the probabilities!

What could be useful so that you can see? That is your likelihood to let your inside Finances Nerd shine. Once you create your personal Targeted Views, you’ll achieve a complete new perspective in your finances.

Listed below are some concepts to get your wheels spinning:

Accomplice Views

Once you’re budgeting with a associate there are three varieties of bills: Yours, Mine, and Ours. Now you’ll be able to create views to match!

What’s vital to you proper now? What’s vital to your associate? Do you’ve got shared financial savings targets? What bills do you’ve got developing? Assist help one another in your private targets and work collectively in your shared targets.

And hey, this type of Customized View may be simply what you want to function in a single finances as a substitute of two. This offers you a brand new manner to have a look at your shared monetary image while you want it.

This will also be tremendous useful in case your associate isn’t fairly as into YNAB as you might be (preserve at it!), and also you simply have to concentrate on a couple of classes to maintain them within the loop. No drawback—this view doesn’t want to incorporate a ton of classes, simply what issues most.

Paycheck Views

Whereas the purpose is that will help you get a month forward of bills, we all know that most individuals don’t begin out in that scenario. We’ve seen YNABers manage their whole finances by paycheck utilizing class teams. Now you should utilize Customized Views as a substitute!

Create a view for the classes you pay out of the primary paycheck of the month, and one other view that exhibits the classes you pay out of the second paycheck. Readability and fast budgeting for the win!

Desires and Wants Views

Typically you simply wish to make sure that the fundamentals are coated earlier than you begin including {dollars} to much less vital classes.

A Desires and Wants view may make it easier to play out these ‘what if’ eventualities. What in the event you misplaced or stop your job? Which classes would completely want to be funded? Create a brand new view and discover out. That is additionally an effective way to learn how a lot it prices to be you for a month with out all of the nice-to-haves.

Themed Views

Typically you group classes collectively for one cause, however would like to view them from a special perspective. You could possibly do a handstand, or simply create a view primarily based on a theme.

You may need all of your month-to-month payments in a single group, non-monthly in one other, and hey, possibly you also have a Want Farm. Wouldn’t or not it’s good to see all of the classes throughout these teams which are associated to your home? Or automobile? Or rekindled love for journey? Straightforward peasy.

Kiddo Views

What about finances classes associated to kiddos? You might manage your parenting bills a technique for good previous day-to-day budgeting, however generally you may wish to see a class breakdown by child. (You all the time knew it was the youngest who was costing you probably the most!)

I Have Questions…

Good! We have now solutions. You’ll discover them right here.

We additionally wish to encourage you to only begin taking part in with and constructing your personal Targeted Views. Get these artistic juices flowing—the probabilities are countless! Warning: as you utilize our Preset Views or construct extra Customized Views, you may get impressed to restructure your finances altogether. An exhilarating new world of complete monetary readability awaits!

Do you know you’ll be able to invite as much as 5 folks to affix your YNAB subscription at no further price? Share budgets and create new views with those you like probably the most.

[ad_2]