[ad_1]

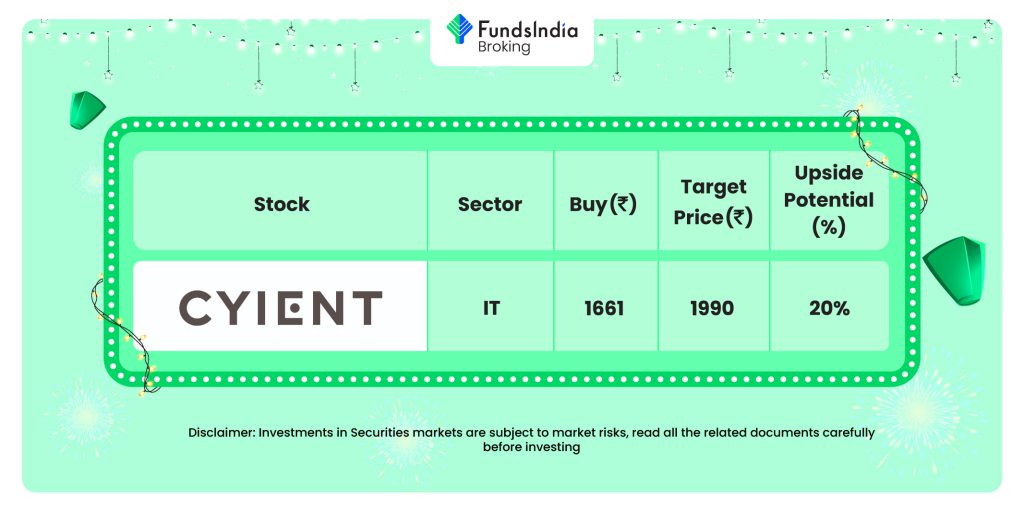

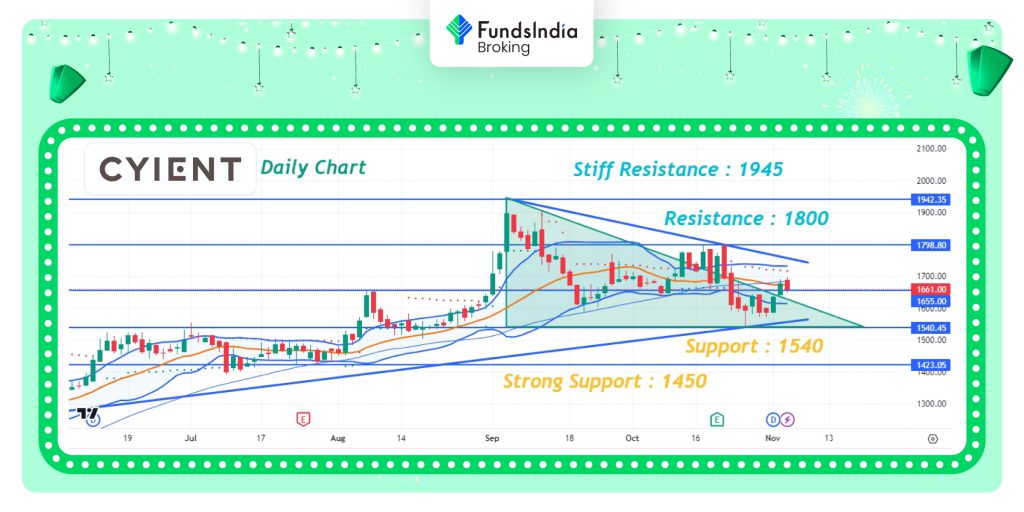

Muhurat Choose – 1: Cyient Ltd

Funding Rationale:

- Cyient Ltd presents area of interest product and course of engineering companies in domains corresponding to communication, aerospace & defence, transportation, mining, power, and utilities. Cyient has constructed sturdy relationships with trade leaders, corresponding to Raytheon Applied sciences Corp, Bombardier Inc, Boeing Co, British Telecommunications Plc and Tele Atlas and will get excessive repeat orders of over 90%. The corporate’s area of interest choices and robust shopper relationships have pushed wholesome income progress during the last 5 years.

- Cyient Restricted has posted a internet revenue for Q2FY24 at Rs.184 crore, up 132% in in comparison with Rs.79 crore throughout the corresponding quarter of final 12 months. The corporate’s income from operations stood at Rs.1778.50 crore in Q2FY24, up 27.4% as in opposition to Rs.1396.20 crore throughout Q2FY23. The corporate’s EBIT stood at Rs.260 crore.

- The corporate has gained two prestigious awards on the NASSCOM Design & Engineering Summit. One was within the space of enabling the blue financial system by way of final mile hydrogen gasoline supply for marine and automotive software and the second was for designing and engineering, the world’s most fuel-efficient plane engine. The corporate has acquired the Fashionable Community Administration Award on the 2023 ESRI Infrastructure Administration and geographic info programs (GIS) Convention. Enabling Blue financial system by way of Final Mile Hydrogen Gasoline supply for Marine and Automotive functions.

Outlook: The corporate is holding on to the 15-20% income progress steerage for FY24 and expects EBIT margins to enhance by 150-250 foundation factors in comparison with FY23. The corporate expects Q3 to be higher than Q2 and anticipates progress within the aerospace and sustainability segments. Cyient will proceed to keep up its wholesome monetary danger profile over the medium time period, with reasonable debt, excessive liquid surplus in absence of any giant debt funded acquisition and a conservative monetary coverage.

Key dangers:-

- The demand atmosphere is unsure as a result of potential risk of recession from the world’s largest economies.

- The rising subcontracting value and cross-currency headwinds could impression working margins negatively.

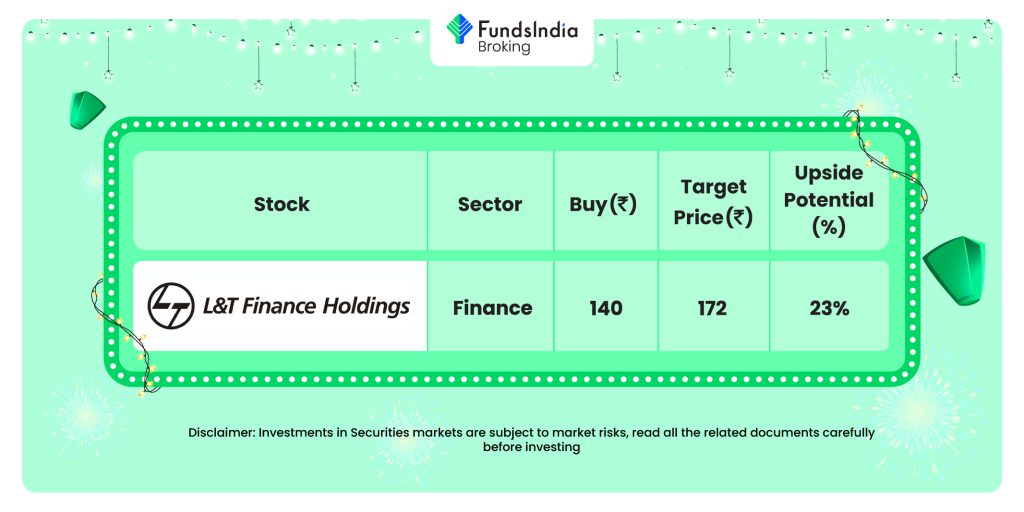

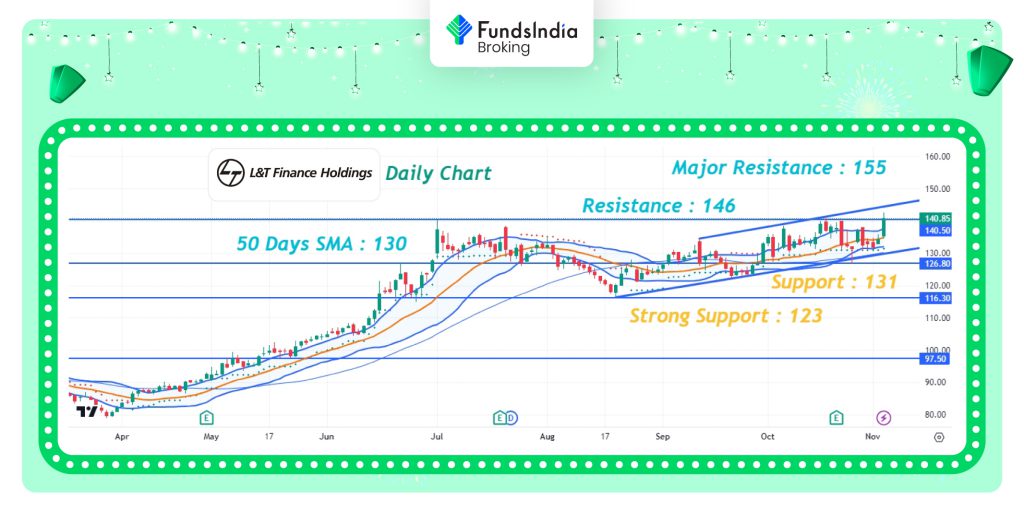

Muhurat Choose 2: L&T Finance

Funding Rationale:

- L&T Finance is a subsidiary of Larsen & Toubro which holds a 63.5% stake within the firm. L&T Finance has turn into an integral a part of the L&T group and it derives fixed technical and capital help from the guardian firm. The Co. acquired an fairness infusion of Rs. 1,900 crore in FY2021 and Rs. 2,000 crore in FY2018. L&T Finance has a diversified product portfolio comprising of Rural Group Loans & Micro Finance (25%),Farm Tools Finance (17%), City Finance- 38% (Residence loans/ loans in opposition to property [18%], Two-wheeler loans[12%], client loans [8%]), SME Finance (2%) and Wholesale Finance- 18% (comprising Actual Property Finance [5%]and Infrastructure Finance [13%].

- L&T Monetary has registered the very best ever retail disbursements and in addition maintained wonderful margins and have additional lowered the credit score value and achieved a 46% PAT progress, registering a PAT of Rs.595 crore. The corporate has already achieved 88% Retailisation in Q2FY24 and its fairly assured of going past 90% in Q3FY24 itself. The retail progress was at 33% YoY on this quarter and a progress of 34% YoY in Q1. The Retail GS3 and NS3 at this time stand at 3.05% and 0.67%, respectively, and even on a consolidated foundation, that is at 3.27% and 0.82%. The retail ROA has grown to three.32%.

- The corporate’s Retail revenue after tax is at Rs.606 crores, up 86% from final 12 months. The Retail ‘NIMs+Charges’ are at nearly an all-time excessive of greater than 12%. The corporate has registered highest ever quarterly retail disbursements of about Rs.13,500 crore, which is up 32%. The retail guide is now at Rs. 69,400 crores, which is up 33% and the Retail ROE now has reached 16.31%.

Outlook:

L&TFH is about to primarily remodel itself right into a retail franchise, which might result in enchancment in general profitability and return ratios. The corporate is realigning its technique by repositioning its portfolio progress from product-based to customer-centric, specializing in cross-selling, up-selling together with utilizing deep analytics to grasp numerous nuances like enterprise choice, seller choice, sale volumes, market positioning in numerous segments, portfolio classic together with buyer behaviour, counter share efficiency, and distribution community, that are key positives.

Key dangers:-

- Slower retail progress and higher-than-anticipated write-off in wholesale and retail NPL cycle.

- Presence in comparatively riskier asset class – The Rural Enterprise Finance and Two-wheeler segments stays dangerous on account of the character of the shopper profile and vulnerability of the debtors’ money flows to financial shocks, as majority of the agricultural debtors belong to the decrease socio-economic background.

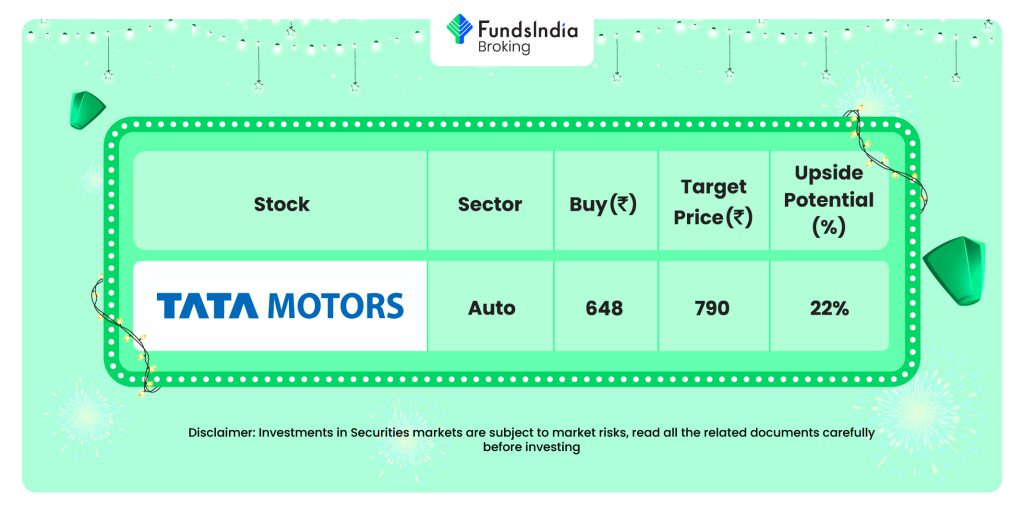

Muhurat Choose 3: Tata Motors

Funding Rationale:

- Tata Motors Group is a number one international car producer. The corporate is the market chief within the home CV trade and one of many high three producers of PVs in India. Within the home CV trade, TML has one of the vital diversified product portfolios with a presence throughout mild, medium and heavy-duty segments of the CV trade. The corporate’s product portfolio within the PV phase additionally spans passenger vehicles and sport utility autos (SUVs).

- The corporate’s income from operations stood at Rs.1,05,128 crore in Q2FY24, up 32% as in opposition to Rs.79,611 crore throughout Q2FY23. The corporate has posted internet revenue for the consecutive 4 quarters. The corporate posted a internet revenue of Rs.3832 crore as in opposition to a internet lack of Rs.898 crore for a similar quarter final 12 months.

- Tata Passenger Electrical Mobility Ltd (TPEM) and Jaguar Land Rover Plc (JLR), each 100% subsidiaries of Tata Motors Restricted (TML), have entered right into a Memorandum of Understanding (MoU) for the licensing of JLR’s Electrified Modular Structure (EMA) platform for a royalty charge (together with electrical structure, electrical drive unit, battery pack and manufacturing know-hows) for the event of TPEM’s ‘premium pure electrical’ autos sequence ‘Avinya’ on the EMA platform. TPEM and JLR may also enter into an Engineering Providers Settlement (ESA) to help TPEM’s change content material necessities for the primary car improvement.

Outlook:-

The order guide remained sturdy with over 168,000 shopper orders, with RR, RR Sport and Defender accounting for 77% of the order guide. Wanting forward, manufacturing and wholesale volumes are anticipated to regularly improve in H2 FY24. The EBIT margin for FY24 is now anticipated to enhance to round 8% in comparison with the 6% plus beforehand indicated. The corporate is anticipating a free money movement of over 2 billion pound in FY24 with internet debt decreasing to lower than 1 billion pound by the top of FY24.

Key dangers:-

- JLR’s value competitiveness in addition to profitability is inclined to foreign exchange motion, significantly the Euro, given the excessive share of imported elements from Europe. Additional, it has vital exports and international foreign money debt, which will increase its publicity to international foreign money fluctuations.

- Slower than anticipated quantity restoration of firm throughout its operations will impression the income progress.

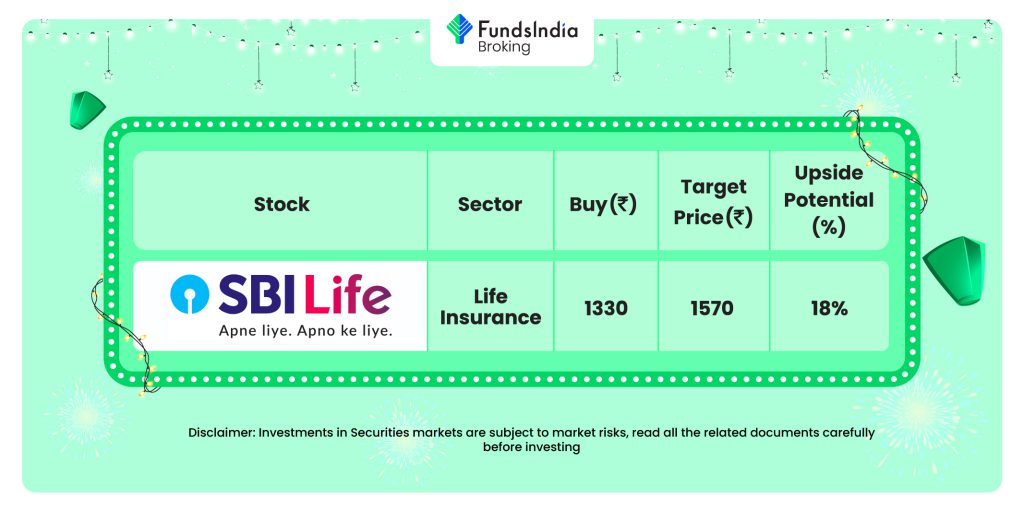

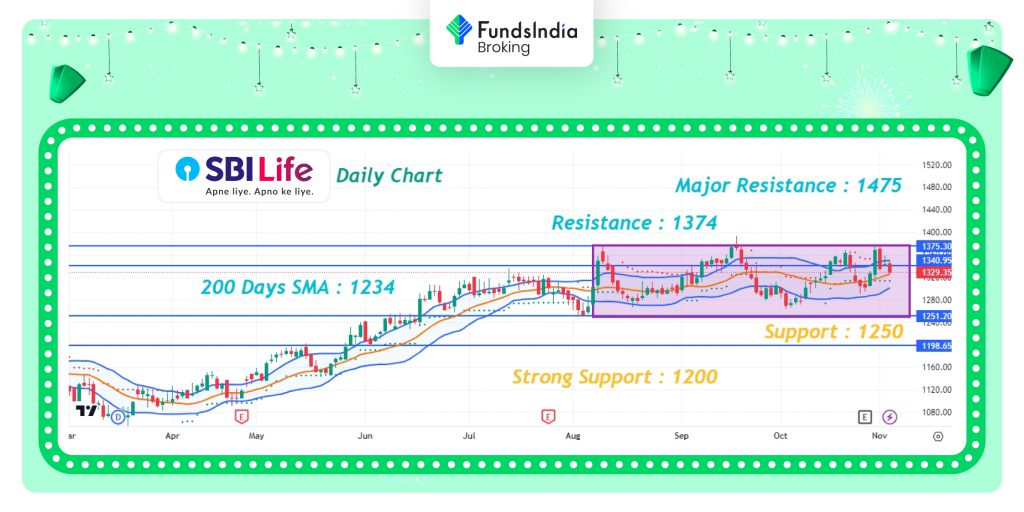

Muhurat Choose 4: SBI Life

Funding Rationale:

- SBI Life, started as a three way partnership between SBI and BNP Paribas Cardif and commenced operations in 2001. The corporate is uniquely positioned to faucet the huge potential of the Indian life insurance coverage sector. SBI Life strives to make insurance coverage accessible to all, with its in depth presence throughout the nation via its 1,011 workplaces, 23,998 workers, a big and productive community of about 236,978 brokers, 73 company brokers and 14 bancassurance companions with greater than 41,000 associate branches, 148 brokers and different insurance coverage advertising companies.

- SBI LIFE reported GWP (Gross Written Premiums) progress of 21.4% YoY (+48.8% QoQ) to Rs.20,176 crore in Q2FY24 led by sturdy progress within the New Enterprise Premium (NBP). In H1FY24, GWP stood at Rs.33,731 crore, a progress of 20.6% primarily pushed by 27.6% progress in single premium progress. NBP for the quarter elevated by 34.1% YoY/ 62.0% QoQ pushed by each the segments viz First Yr phase (+33.1% YoY) and single premium phase (+35.0% YoY). The renewal phase grew by 10.9% YoY (+37.7% QoQ).

- As of September 30, 2023, the entire variety of brokers stood at 236,978, a progress of 33.0% over the earlier interval. In H1FY24, the Firm added a internet of 28,204 brokers. SBI life will introduce two or extra merchandise within the non-par financial savings phase. The corporate additionally engaged on the excellent overview of the rider portfolio as this can assist them to not solely improve the safety but additionally improve financial savings product.

Outlook:-

The efficiency of SBI Life has been constantly bettering led by progress, margins, value ratio, and persistency. The corporate’s VNB margin, though fallen QoQ, stands wholesome within the trade which is led by the bettering product combine and working leverage. SBI Life enjoys aggressive value ratios within the trade which assist it keep a superior margin profile.

Key dangers:-

- Intense competitors from different non-public life insurers could make it difficult for the corporate to keep up profitability. Furthermore, with the dominant place of the Life Insurance coverage Company of India within the home market, non-public gamers must repeatedly innovate to draw prospects, and in addition handle the returns expectation of coverage holders.

- Modifications within the rates of interest would adversely impression sure merchandise provided by the corporate.

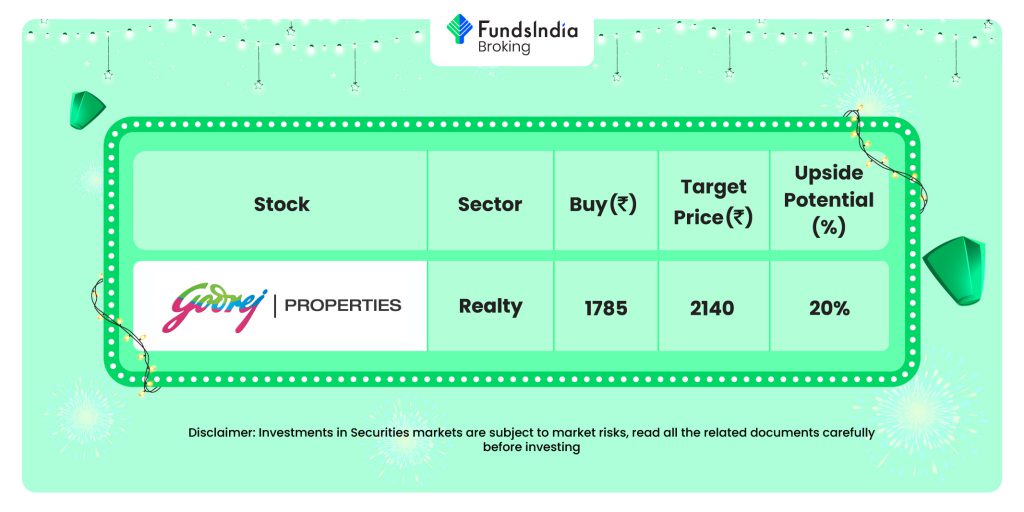

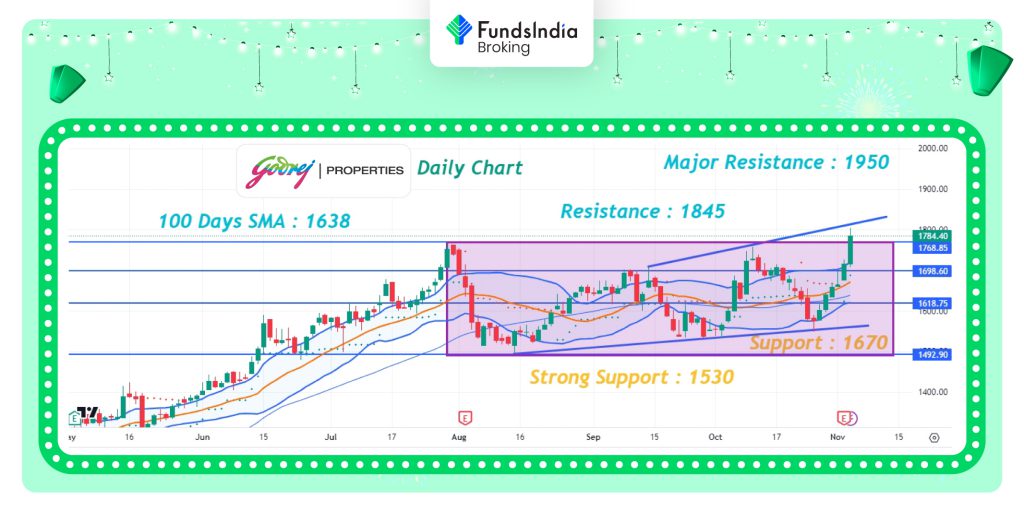

Muhurat Choose 5: Godrej Properties

Funding Rationale:

- Godrej Properties Restricted (GPL) is the actual property improvement arm of the Godrej Group, which was began in 1897 and is at this time one in all India’s most profitable conglomerates. Godrej Properties brings the Godrej Group philosophy of innovation, sustainability, and excellence to the actual property trade. At current, GPL is current in 10 cities in India and focuses totally on residential actual property improvement.

- Godrej Properties is the India’s largest developer by variety of houses offered in FY23. Efficiently delivered ~38 million sq. ft. of actual property previously 5 years. As of Q2FY24, it has ~214 million sq. ft. of saleable space throughout India. They’ve added 61 residential tasks with ~121 million sq. ft. saleable space since FY2018.

- Income got here in at Rs.343 crore (+108%/-64% YoY/QoQ, a 49% miss). This was on the again of 1.6 msf of supply throughout the quarter. GPL is focusing on 12.5 msf of deliveries for FY24 with 6.5 msf delivered YTDFY24. Presales for Q2FY24 was highest ever in any quarter and stood at Rs.5030 crore (+109%/+123% YoY/QoQ), with a reserving space of 5.2msf (+93%/+133% YoY/QoQ). This was on again of primarily two tasks i.e. Godrej Tropical Isle in Noida which was GPL’s most profitable launch ever attaining a reserving worth of Rs.2000 crore.

Outlook:-

On again of the sturdy presales, GPL is assured of attaining INR 140bn+ of focused presales in FY24. GPL added one new undertaking with a gross improvement worth of INR 7.3bn in Q2FY24, taking the entire YTD GDV addition to INR 72bn, on observe, with focused INR 150bn of GDV addition in FY24. Nevertheless, given a robust launch pipeline of ~18msf and progress visibility of two to 3 years, GPL shall be including tasks on alternative foundation in a lot of the present markets.

Key dangers:-

- The actual property sector is cyclical and has a extremely fragmented market construction due to the presence of numerous regional gamers.

- As well as, being a cyclical trade, the actual property sector is very depending on macro-economic components, which in flip exposes the corporate’s gross sales to any downturn in demand.

Different articles it’s possible you’ll like

Submit Views:

93

[ad_2]