[ad_1]

Financial principle means that political uncertainty impacts international locations’ anticipated money flows. Extremely rated (low political uncertainty) international locations exhibit increased anticipated money flows. The identical holds true for financial coverage uncertainty, with extremely rated (low financial uncertainty) international locations exhibiting increased anticipated money flows. Financial principle additionally means that political and financial uncertainty are mirrored in low cost charges (threat premiums required), with extremely rated (low uncertainty) international locations having decrease low cost charges and thus increased valuations. These decrease low cost charges result in decrease anticipated returns—threat and anticipated return are positively correlated. The result’s that international locations with larger political and financial coverage uncertainty (riskier international locations to put money into) ought to have increased anticipated returns.

To check whether or not principle aligns with empirical proof, Vito Gala, Giovanni Pagliardi and Stavros Zenios, authors of the examine “World Political Threat and Worldwide Inventory Returns,” revealed within the June 2023 concern of the Journal of Empirical Finance, examined whether or not politics-policy uncertainty predicts variation in inventory market returns throughout international locations. They constructed a ‘P-factor’ that acknowledges “two distinct, but interrelated, dimensions of the multifaceted political threat: instability of a authorities, i.e., electoral threat; and uncertainty about its financial insurance policies, i.e., coverage threat.” They built-in these two measures of political threat (politics-policy) right into a bivariate threat issue (P-factor). They proxied politics-policy utilizing survey-based measures of political stability and confidence in authorities financial coverage from the Ifo World Financial Survey (WES). The survey offered knowledge on the financial, monetary and political local weather throughout 42 international locations and lined the interval 1992-2016. Politics scores ranged from 1 to 9 for probably the most politically secure international locations and from 0 to 100 for international locations with the best confidence in authorities financial coverage.

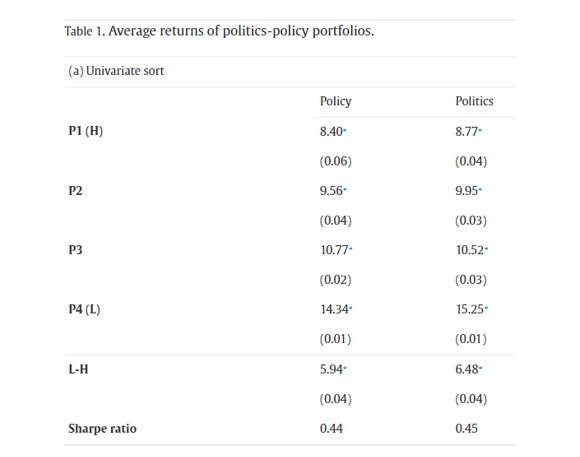

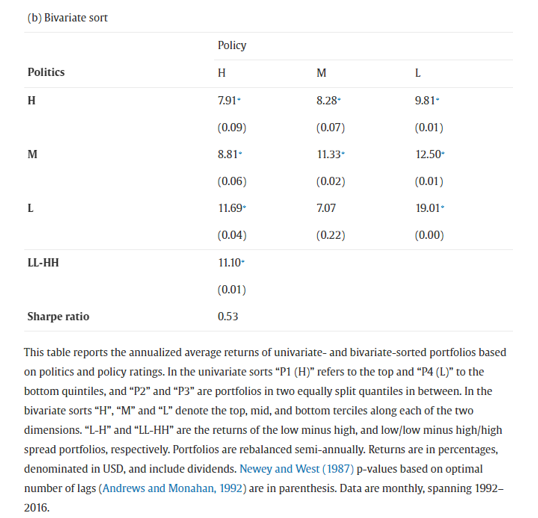

The authors sorted international locations first by the much less unstable politics after which by the extra unstable coverage. They then constructed the P-factor because the return of an equally weighted zero-cost tradable portfolio, going lengthy on the international locations within the backside terciles of politics and coverage and brief on the international locations within the prime terciles. Portfolios had been based mostly on the final day of the month of every WES announcement and had been rebalanced semiannually. Here’s a abstract of their key findings:

Political and coverage uncertainty predicted inventory market variability throughout international locations—politics-policy scores forecasted financial development and inventory market returns throughout international locations and utilizing each politics-policy measures improved the political threat issue identification. Excessive politics and coverage scores forecast excessive future money circulate development. They estimated that a rise in a rustic’s coverage (politics) scores as much as the following quartile would yield on common a rise in future annual GDP development of 0.52% (0.80%). Excessive politics and coverage scores additionally forecast low future volatilities.

Forming portfolios of nations sorted on their politics and/or coverage scores produced a monotonic cross-section of portfolio returns alongside each dimensions. The low politics portfolio outperformed the excessive politics portfolio by a statistically important 6.48percentper annum, and the low coverage portfolio outperformed the excessive coverage portfolio by 5.94% every year, with comparable Sharpe ratios.

World scores confirmed appreciable time-series variation, and so they deteriorated with important political or financial coverage shocks having detrimental results, indicating sturdy spillovers throughout international locations.

The bivariate unfold portfolio that was lengthy on low politics-policy and brief on excessive politics-policy (the P-factor) produced a statistically important common return of 11.10% every year and a Sharpe ratio of 0.53.

Exposures to international and native threat elements of six outstanding asset pricing fashions couldn’t account for politics-policy predictability—assessments confirmed that variations in returns throughout politics, coverage and politics-policy portfolios weren’t as a consequence of threat premia on present elements.

Augmenting the worldwide market portfolio with the P-factor considerably lowered pricing errors and improved cross-sectional match.

Politics-policy uncertainty affected returns by each cash-flow and low cost price channels. They confirmed that political scores have an effect on the low cost price by demonstrating that they predicted future market volatilities on the six- and 12-month horizons. For the 12-month funding horizon, they estimated that a rise in a rustic’s coverage (politics) scores as much as the following quartile would yield on common a lower in future annual inventory market returns of 1.73% (3.24%).

Correlations of the politics-policy variables with 16 different macroeconomic and monetary variables from the WES knowledge are low and insignificant. A political issue on the 16 variables nonetheless carried a big and statistically important premium.

In assessments of robustness, the authors confirmed their outcomes utilizing different measures of political threat—the Worldwide Nation Threat Information (ICRG) nation scores, the financial coverage uncertainty index (EPU) and the World Financial institution political stability indicators (WB).

Their findings led the authors to conclude: “Political uncertainty around the globe, whereas originating domestically, creates widespread systematic variation throughout international locations resulting in priced international political threat. … Asset pricing assessments verify that international political threat is priced.” They added: “We verify empirically that politics-policy scores forecast financial development and inventory market returns throughout international locations, and utilizing each politics-policy measures improves the political threat issue identification.”

Investor Takeaways

The financial principle means that international locations with larger political and financial coverage uncertainty (riskier international locations to put money into) have increased anticipated returns (although not assured). It’s not shocking that the empirical proof demonstrates that international locations with larger political and financial coverage uncertainty have produced increased returns, as threat and anticipated returns had been positively correlated. For buyers looking for increased returns, there are not any free lunches—they’ve to just accept larger threat. One other essential takeaway is that Gala, Pagliardi and Zenios demonstrated that decrease political uncertainty will increase future anticipated money flows (which improve inventory costs, rising realized returns) however reduces future anticipated returns.

Larry Swedroe has authored or co-authored 18 books on investing. His newest is Your Important Information to Sustainable Investing. All opinions expressed are solely his opinions and don’t mirror the opinions of Buckingham Strategic Wealth or its associates. This data is offered for common data functions solely and shouldn’t be construed as monetary, tax or authorized recommendation.

[ad_2]