[ad_1]

Welcome again to a different month-to-month replace from Root of Good! We simply acquired again to Raleigh after a two week cruise to Alaska over the last half of September. Alaska actually exceeded expectations with its pure magnificence and landscapes.

After a busy summer season, we have now an equally busy fall journey season as properly. We now have a pair extra days in Raleigh after which we head to the Caribbean for one more roughly two week cruise. Climate allowing, in fact.

Proper now I’m enjoying the journey agent making an attempt to maintain up with rebooking flights, accommodations, and probably cruises as we get hurricane-related cancellations and notifications this week. That is our first actual cruise journey hiccup associated to a hurricane. I feel we’ll find yourself doing okay with out lacking out on a lot of our journey.

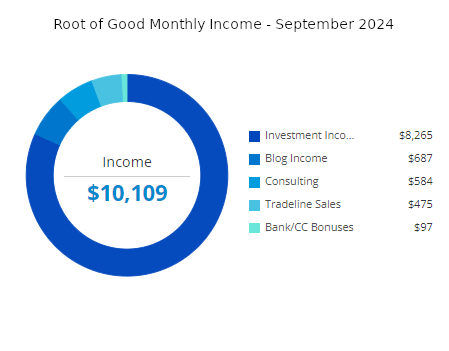

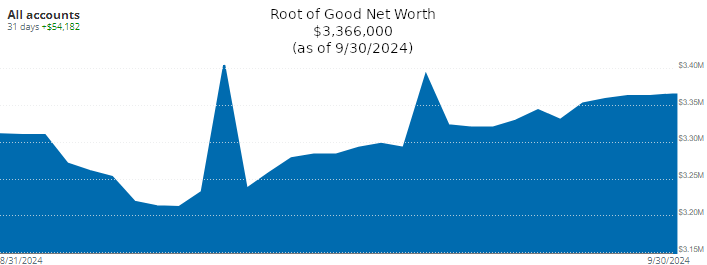

On to our monetary progress. September was one other nice month for our funds. Our internet price shot up by $54,000 to finish the month at $3,366,000. Our revenue of $10,109 was considerably greater than our spending of $1,768 for the month of September.

Let’s bounce into the small print from final month.

Revenue

Funding revenue totaled $8,265 in September. Our fairness index funds and ETFs pay dividends quarterly on the finish of March, June, September, and December. Consequently, we had a bigger than regular quantity of funding revenue final month. Right here’s extra on our dividend investments.

Weblog revenue totaled $687 for the month. This represents a beneath common month of weblog revenue.

My early retirement way of life consulting revenue (“consulting”) was $584 final month. This represents three hours of consulting work. I’m making an attempt to squeeze in consulting periods whereas I’m at residence in Raleigh in between cruises.

Tradeline gross sales revenue totaled $475 in September. One other good month however not fairly as excessive as August. I ramped up my tradeline gross sales just a few years in the past and mentioned it in a bit extra element in my October 2020 month-to-month submit and in my July 2021 month-to-month submit. Most years I make round $4,000 to $6,000 in change for lending out my stellar credit score historical past from half a dozen bank cards.

For final month, my “deposit revenue” was $0. Throughout most months I get $10 or $20 from money again and incentive bonuses from the Rakuten.com and Mrrebates.com on-line buying portals (a few of which was earned from you readers signing up by these hyperlinks).

In the event you join Rakuten by this hyperlink and make a qualifying $25 buy by Rakuten, you’ll get a $10 enroll bonus (or extra!).

My financial institution and bank card bonuses totaled $97 final month. These funds have been sitting in my Citibank bank card money again account for fairly some time and I lastly cashed them out.

In the event you’re excited about monitoring your revenue and bills like I do, then try Empower Private Dashboard, previously often known as Private Capital (it’s free!). All of our financial savings and spending accounts (together with checking, cash market, and greater than half a dozen bank cards) are all linked and up to date in actual time by Empower Private Dashboard. We now have accounts far and wide, and Empower Private Dashboard makes it very easy to test on every part at one time.

Empower Private Dashboard can also be a strong software for funding administration. Holding observe of our complete funding portfolio takes two clicks. In the event you haven’t signed up for the free Empower Private Dashboard service, test it out at the moment (evaluate right here).

Monitoring spending was one of many vital steps I took that allowed me to retire at 33. And it’s now simpler than ever with Empower Private Dashboard.

Bills

Now let’s check out September bills:

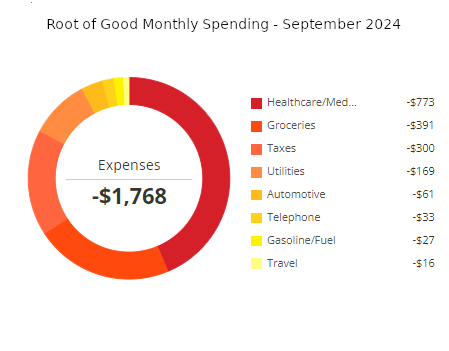

In complete, we spent $1,768 through the month of September which is about $1,500 lower than our recurrently budgeted $3,333 per thirty days (or $40,000 per 12 months). Healthcare and groceries have been the 2 largest classes from final month.

Detailed breakdown of spending:

Healthcare/Medical/Dental – $773:

Our present 2024 medical insurance is free, due to very beneficiant Inexpensive Care Act subsidies that we obtain resulting from our low ~$48,000 per 12 months Adjusted Gross Revenue.

Our 2024 dental insurance coverage plan prices $37 in premiums per thirty days. We picked a plan from Truassure by the healthcare.gov change. The dental insurance coverage does a superb job of overlaying routine cleanings, exams, and x-rays plus most of the price of fundamental procedures like fillings.

The rest of our healthcare/dental spending was a $736 expense for a dental process final month. We anticipate to have some extra dental bills developing quickly.

Groceries – $391:

We have been solely residence 13 days throughout September so our grocery spending was comparatively modest. We did come again residence and restock our fridge, freezer, and pantry in very early October so maybe our spending in October will likely be slightly larger in consequence.

After we are gone on cruises we don’t spend something on groceries. So we’re “saving” cash after we are touring for affordable or free on cruises. That’s what I inform myself.

Taxes – $300

Our quarterly estimated state revenue tax got here due throughout September. $300 went to the State of North Carolina.

Utilities – $169:

We spent $169 on our water/sewer/trash invoice final month. I paid our pure fuel invoice twice in August so we spent $0 on pure fuel throughout September. I paid our electrical invoice initially of October as soon as we have been residence, so we spent $0 on electrical energy through the month of September.

Automotive – $61:

A $61 oil change for our minivan. Our Toyota Sienna is 15 years outdated at this level. The auto store advisable $7,700 (!!) in prompt repairs for the automobile however none of them are essential any time quickly. Finally I’ll have to switch 2 or 4 tires within the subsequent few months or years and the brakes will want changing in some unspecified time in the future.

I used to be blown away at their capacity to seek out all these strategies and at their audacity to suggest them for a 15 12 months outdated car not even price $7,700 any longer. In different information, I is perhaps searching for a brand new auto store that’s extra in tune with my want to maintain this automobile buzzing alongside for a number of extra years with out spending nearly 5 figures to take action. Sorry, gross sales supervisor!

Phone – $33:

We use Redpocket Cellular’s annual plan that prices $33 for the annual renewal. After paying for renewals on 2 traces in August, a 3rd line’s renewal got here due in September. These are very gentle on knowledge at solely 200 MB per thirty days however we are able to add additional MB’s of knowledge for a small charge on an as-needed foundation. Up to now these are working properly for fundamental communication round city.

Gasoline – $27:

My daughter refueled our Hyundai for $27 earlier than selecting us up from the airport. Concierge service at its most interesting!

Journey – $16:

We spent $6 on the comfort charge to pay our $300 quarterly estimated tax invoice utilizing a bank card. I get a variety of factors and miles from bank card spending so I deal with charges like this $6 as a “journey” expense because it earns us a lot “free” journey.

The opposite $10 in journey spending was for two pairs of native transit tickets in Vancouver, Canada to get from our airport lodge to the downtown cruise port, then return from the cruise port to the airport two weeks later. Their transit costs have been very affordable given the prolonged journey we took on the prepare.

That’s all of the spending we did on the cruise. All the pieces was pay as you go many months in the past. I used factors for the lodge and flights apart from about $110 in complete for the flight taxes. The 2 week Alaska cruise aboard the Holland America Noordam was about $1,000 out of pocket for us with a “free” on line casino promo price, together with gratuities. I managed to pay the $1,000 taxes, charges, and gratuities utilizing my Chase Final Rewards factors by my Chase Sapphire Reserve card.

A roughly $10,000 trip ended up costing us solely $120 in money. That’s wonderful!

Whereas en-route to and from the cruise, we managed to dine in a number of airport lounges alongside the best way so we didn’t want to purchase any meals or drinks on our journey. The Capital One Lounge in Denver even had to-go luggage particularly designed to permit lounge company to pack a snack for later. Very handy and frugal!

Get free journey like us

If you’re excited about getting free journey out of your bank card like I do, take into account the Chase Ink Limitless enterprise playing cards (my referral hyperlink). Proper now, the Chase Ink Limitless enterprise card affords an above common $900 price of Chase Final Rewards factors that may be redeemed immediately for $900 in money (or much more for journey!). I simply signed up for one more new Ink card to snag one among these nice bonus affords.

Chase is fairly liberal in terms of “what’s a enterprise”. In the event you promote stuff on eBay or Craigslist or do some odd jobs sometimes then you have got a enterprise and will get a bank card as a “sole proprietor”.

I take advantage of the 90,000 Chase Final Rewards factors by transferring them to my Chase Sapphire Reserve card (additionally providing a 60,000 level enroll bonus proper now). With the Sapphire Reserve card, I can get 1.5x the factors worth by reserving cruises, flights, accommodations, or rental vehicles by their journey portal. For instance, I used 165,000 Chase Final Reward factors to pay for the $2,475 in taxes, charges, and gratuities on two of my cruises. Or I can switch these Final rewards factors to over a dozen journey companions’ airline/lodge applications like United, Southwest, or Hyatt.

Capital One VentureX card

One other favourite journey card in my pockets is the Capital One Enterprise X card. The Enterprise X card is a “keeper” for me. First off, it comes with a $750 enroll bonus after spending $4,000 within the first three months. The bonus is paid within the type of 75,000 bonus factors that you may redeem in opposition to any journey purchases from anyplace. You then earn a strong 2 factors per greenback spent ceaselessly! The opposite massive perk is airport lounge entry. You may get your self plus limitless company into Precedence Go lounges. And also you and two of your company can get into Plaza Premium community lounges and Capital One Lounges.

The Capital One Enterprise X card does have one catch – a $395 annual charge. However they reward you yearly with a simple to make use of $300 journey low cost plus $100 price of factors. Collectively, that makes $400 they provide you yearly which utterly offsets the annual charge. One other profit price mentioning: you’ll be able to add as much as 4 approved customers without spending a dime, and so they additionally get all the advantages of the Enterprise X card together with the dear airport lounge entry. We used this perk to “present” a pair of Enterprise X playing cards with airport lounge entry to my brother in legislation and his spouse to make use of on their household journey again residence to Cambodia final April with their two younger youngsters.

For the reason that annual charge is offset in full by journey credit annually, I personally plan on protecting the Enterprise X card ceaselessly because the card advantages are so nice.

Cable/Satellite tv for pc/Web – $0:

We normally pay $25 per thirty days for an area lowered price bundle resulting from having a decrease revenue and having children. 50 mbit/s obtain, 10 mbit/s add. I didn’t pay the September invoice till early October so there will likely be 2 months’ price of expenses of web on my subsequent month-to-month replace.

Spending for 2024 – Yr to Date

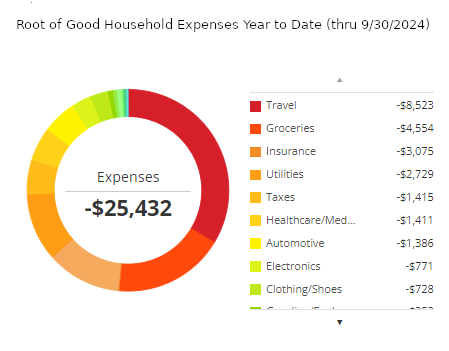

We spent $25,432 for the primary 9 months of 2024. This annual spending is about $4,500 lower than the budgeted $30,000 for 9 months per our $40,000 annual early retirement finances. I haven’t elevated our annual finances for inflation in a decade, so in some unspecified time in the future I have to revisit the finances numbers. Up to now, so good! No want to provide ourselves a increase if we’re managing simply superb inside the present finances.

We’re working beneath finances for the 12 months to date. Nonetheless we have now some upcoming dental bills that might improve our bills as much as or past our annual spending goal. The excellent news is that our HSA has grown over time to a gift worth simply over $100,000. So if we have to, we are able to cowl a big dental or medical invoice out of the HSA account with out paying any taxes on the withdrawal.

The remainder of 2024 will see comparatively modest baseline spending apart from the annual property tax invoice that went up considerably this 12 months. Maybe we’ll begin reserving some extra journey for the spring and summer season earlier than 12 months finish as properly.

Month-to-month Expense Abstract for 2024:

Abstract of annual spending from greater than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $25,432 (by 9/30/2024)

Web Price: $3,366,000 (+$54,000)

Our internet price shot up by $54,000 to finish the month at $3,366,000. This marks a brand new all time excessive internet price for us. I’m all the time anticipating a giant drop after an enormous runup like this, however to date we’ve been fortunate. Who is aware of how excessive it’ll go?

We’ve been on the street rather a lot so I don’t actually take note of the portfolio daily. Thankfully index funds do very well on their very own if you happen to simply allow them to sit there for a decade or two. The truth that you’ll be able to completely ignore your investments and journey world wide and nonetheless generate profits long run is unimaginable.

For the curious, our internet price reported above consists of our residence worth (which is absolutely paid off). I worth the home at $300,000, which might be what we’d internet after gross sales bills. Nonetheless, please word that I don’t take into account my residence worth as a part of my portfolio for “4% rule” calculation functions. I notice of us ask me about that each month so I simply needed to state that right here for readability.

Closing ideas

First off, due to all of you who realized I’m situated in North Carolina and reached out to test on me after seeing {that a} massive nasty hurricane rolled by our state. We’re all superb right here in Raleigh since we’re a pair hundred miles east of the place all the foremost injury occurred.

Virtually two weeks later and it’s nonetheless fairly ugly within the mountainous western portion of our state, however fortuitously the central and japanese components of our state have been principally unaffected. Nonetheless, within the western a part of the state, crews will likely be working for months to get all of the water, sewer, electrical energy, telecoms, roads, and bridges rebuilt. For instance simply how unhealthy it’s, the foremost freeway between North Carolina and Tennessee, Interstate 40, received’t reopen for a full 12 months!

Pure disasters assist put your struggles in perspective.

This week we have now been scrambling to rearrange our journey round Hurricane Milton. The hurricane is on the verge of blowing throughout the state of Florida as this submit goes stay and all studies point out the injury will likely be extreme.

In some unspecified time in the future I noticed that I used to be extra involved about discovering a flight to Florida to get on my cruise whereas hundreds of thousands of individuals within the direct path of the storm are far more fearful in regards to the lack of their houses, companies, and even their lives.

So I took a step again and stated “properly, it will be good to go on this cruise we have been trying ahead to however the losses we face from this storm are nothing in comparison with what the residents of Florida are going through”.

And that’s the place we’re. Hoping we nonetheless get to journey to Florida later this week to get on a cruise. However properly conscious that if we don’t make it, then we’ll nonetheless be far more lucky than a variety of others which might be going through a lot larger losses.

That’s it for me this month. See you in November!

Who’s prepared for some cooler climate heading into fall? I can’t imagine Halloween is nearly right here!

Need to get the most recent posts from Root of Good? Be certain that to subscribe on Fb, Twitter, or by e mail (within the field on the prime of the web page) or RSS feed reader.

Associated

Root of Good Recommends:

- Private Capital* – It is the very best FREE solution to observe your spending, revenue, and whole funding portfolio multi function place. Did I point out it is FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus if you switch $100,000 to Interactive Brokers zero charge brokerage account. For transfers beneath $100,000 get 1% bonus on no matter you switch

- $750+ bonus with a brand new enterprise bank card from Chase* – We rating $10,000 price of free journey yearly from bank card enroll bonuses. Get your free journey, too.

- Use a buying portal like Ebates* and save extra on every part you purchase on-line. Get a $10 bonus* if you enroll now.

- Google Fi* – Use the hyperlink and save $20 on limitless calls and texts for US cell service plus 200+ international locations of free worldwide protection. Solely $20 per thirty days plus $10 per GB knowledge.

* Affiliate hyperlinks. In the event you click on on a hyperlink and do enterprise with these corporations, we might earn a small fee.

[ad_2]