[ad_1]

Jesse Livermore as soon as stated, “One other lesson I discovered early is that there’s nothing new in Wall Avenue. There can’t be as a result of hypothesis is as previous because the hills. No matter occurs within the inventory market immediately has occurred earlier than and can occur once more.”

Truthful level.

Human nature is the one fixed throughout all market environments.

Alternatively, Warren Buffett as soon as stated, “If previous historical past was all that’s wanted to play the sport of cash, the richest individuals can be librarians.”

Additionally a good level.

Everybody has entry to historic details about the markets nowadays, however it doesn’t essentially make it any simpler to outperform.

So which one is it?

Are the cycles at all times the identical or are they at all times totally different?

Effectively it’s somewhat of each.

Human nature by no means adjustments — worry, greed, envy, and many others. — however markets and our reactions to them do change relying on the surroundings. Markets are exhausting to foretell as a result of individuals are exhausting to foretell.

Take recency bias for example.

Typically buyers develop into complacent by assuming the present market or financial surroundings will final ceaselessly, failing to acknowledge the inherent cyclicality in our system.

Different occasions buyers struggle the final conflict by assuming the subsequent threat will look precisely just like the final threat.

The Nice Monetary Disaster and its aftermath are an ideal instance these competing mindsets.

The 2010s lulled buyers to sleep in a world of low, progress, low inflation and low charges which felt prefer it was the brand new regular. It was till it wasn’t.

The 2008 crash additionally led many buyers to imagine each downturn was going to result in a systemwide meltdown, inflicting individuals to search for the subsequent massive brief at each flip.

In case your solely baseline for an financial contraction is the GFC, you mistakenly assume the housing market crashes and the inventory market will get obliterated each time there’s a recession.

The inventory market does are inclined to get harm when the financial system slows however it’s not at all times in full meltdown. There’s a distinction between a bear market and a crash.

So far as housing costs are involved, they will fall throughout a recession however it occurs far much less typically than you suppose.

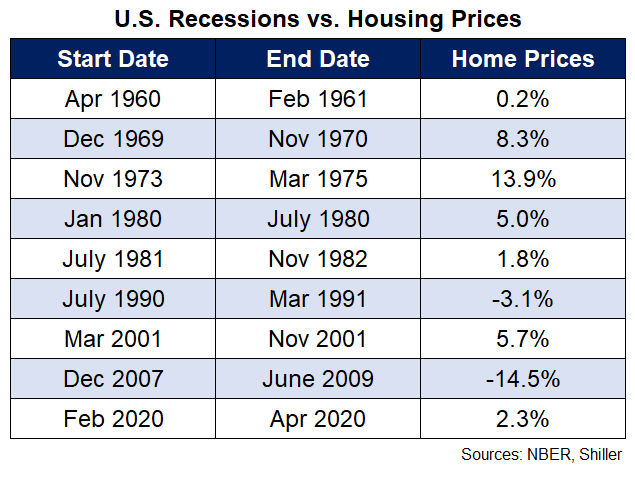

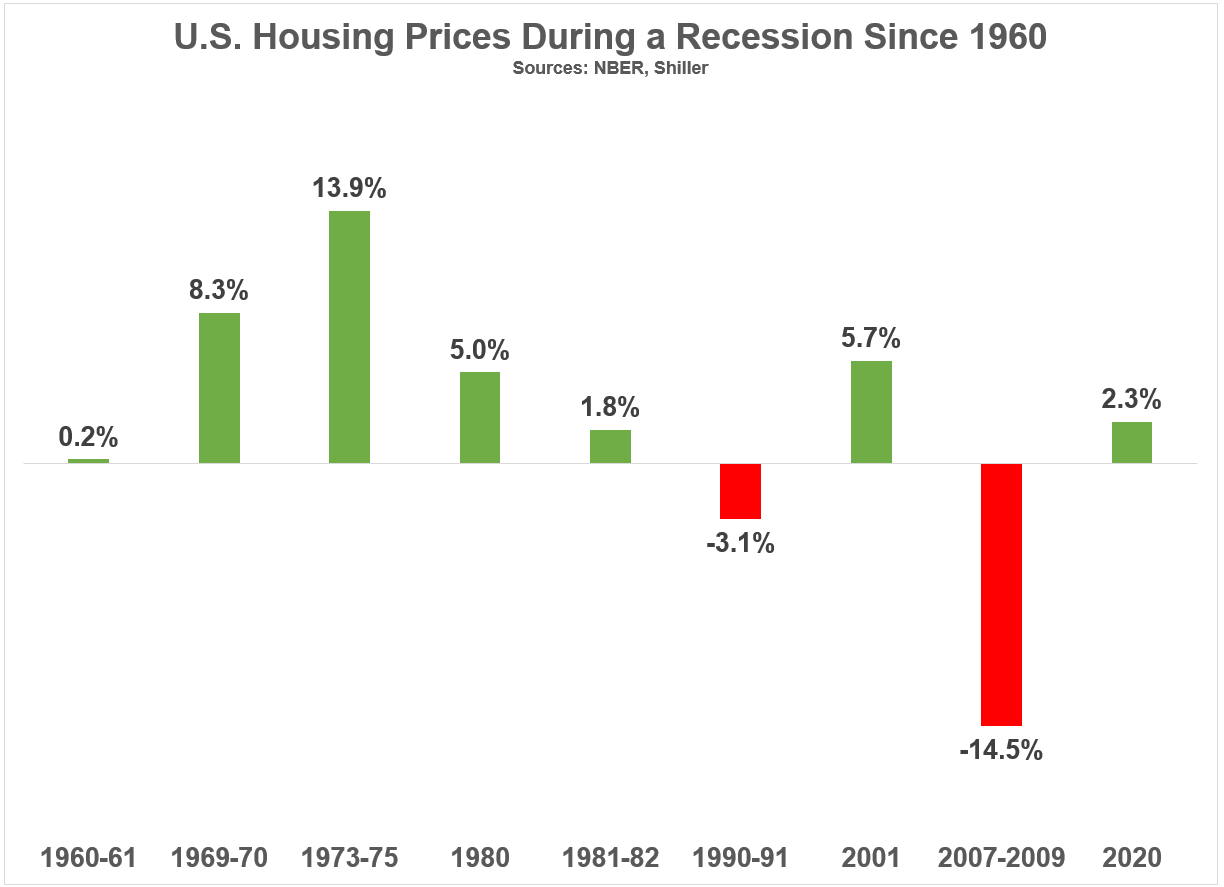

I checked out each recession going again to 1960 to see how housing costs1 within the U.S. held up throughout an financial contraction:

Right here’s the information in bar chart type for the visible learners:

Type of stunning, proper?

The Nice Monetary Disaster was a gut-punch however that was a hen and the egg downside. A nasty housing market helped trigger the recession, not the opposite method round.

The early Nineties recession additionally wasn’t nice for housing costs.

However housing costs truly rose in 7 out of the previous 9 recessions.

Fairly exceptional.

OK, in order that’s historic information. What in regards to the current?

It looks like housing costs ought to fall given the insane run-up in costs and mortgage charges we’ve skilled.

The problem with the present surroundings is we’re in a bizarre place within the housing market due to the transfer in mortgage charges from 3% to eight% in such a rush.

Employment has been rising, GDP has been booming, but house gross sales have been crashing. It’s an admittedly odd set of market dynamics.

If we get a recession and mortgage charges fall, it’s doubtless we’ll get a growth from pent-up demand for housing given the unaffordability ranges have saved many patrons and sellers on the sidelines.

The argument from the eternally bearish crowd shall be as soon as we go right into a recession the unemployment charge will rise and that can trigger pressure on homebuyers and householders alike.

That’s definitely doable.

However let’s say the unemployment charge goes from 4% to six% or 7% within the subsequent recession. That’s not good however it means 93-94% employment. Folks hunker down in a recession however life goes on.

Issues will worsen if we go right into a recession however shoppers are in a significantly better place than they have been heading into the 2008 disaster.

The newest report from the New York Fed tells the story right here.

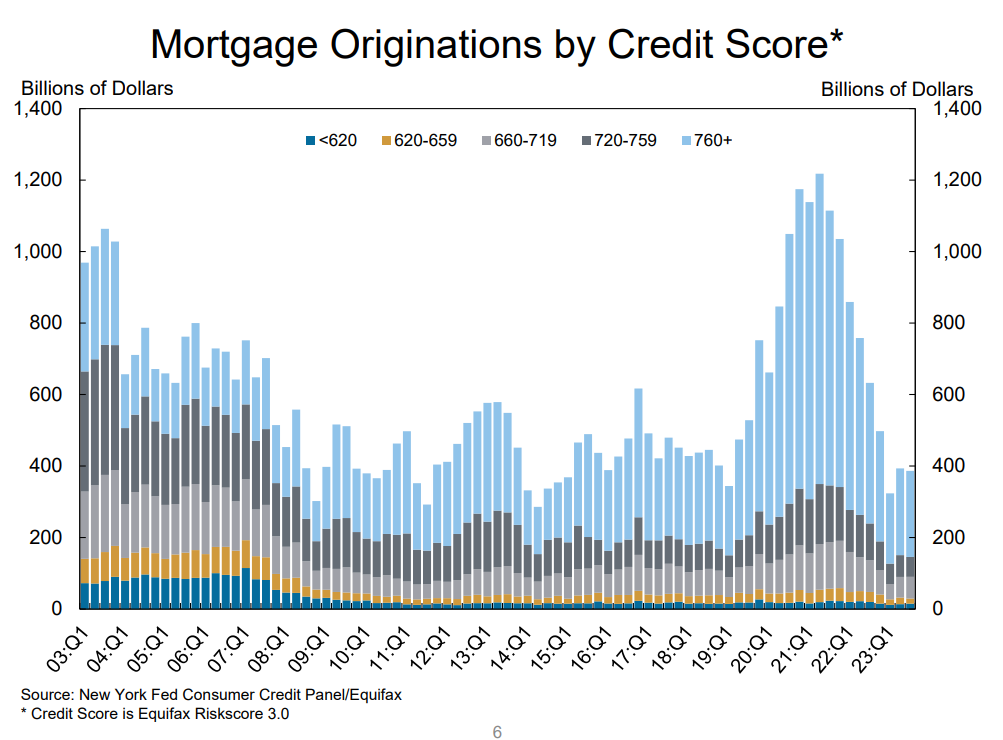

That is certainly one of my favourite charts of the 2000s, which exhibits mortgage originations by credit score rating:

The individuals shopping for homes within the early-2000s housing bubble had fairly horrible credit score scores. This cycle, credit score scores for homebuyers have been significantly better.

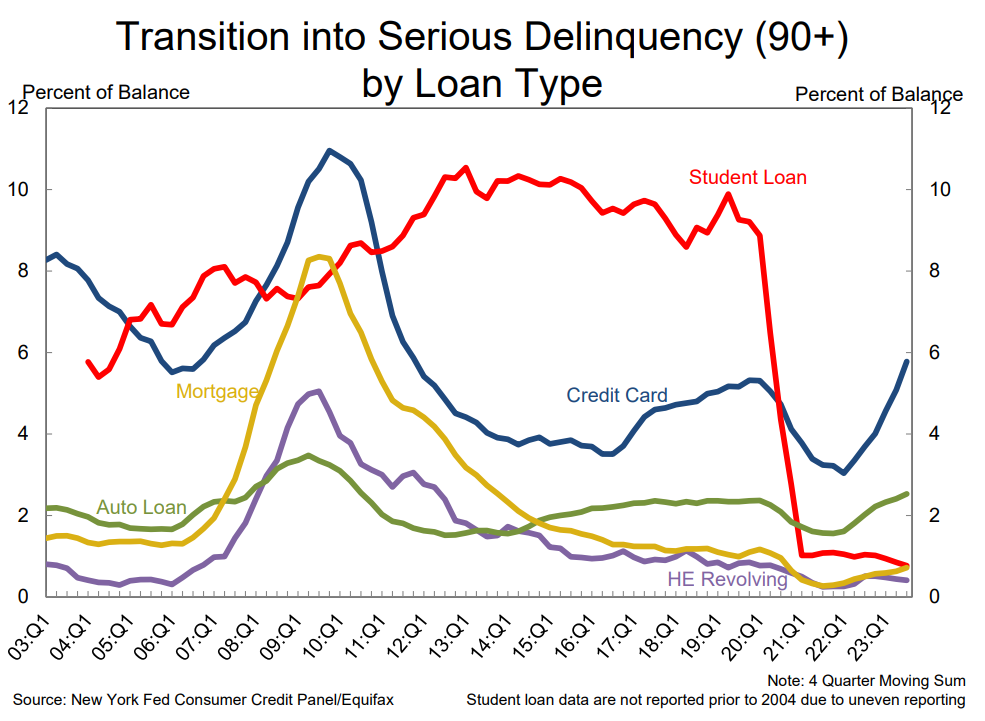

Mortgage delinquencies stay low:

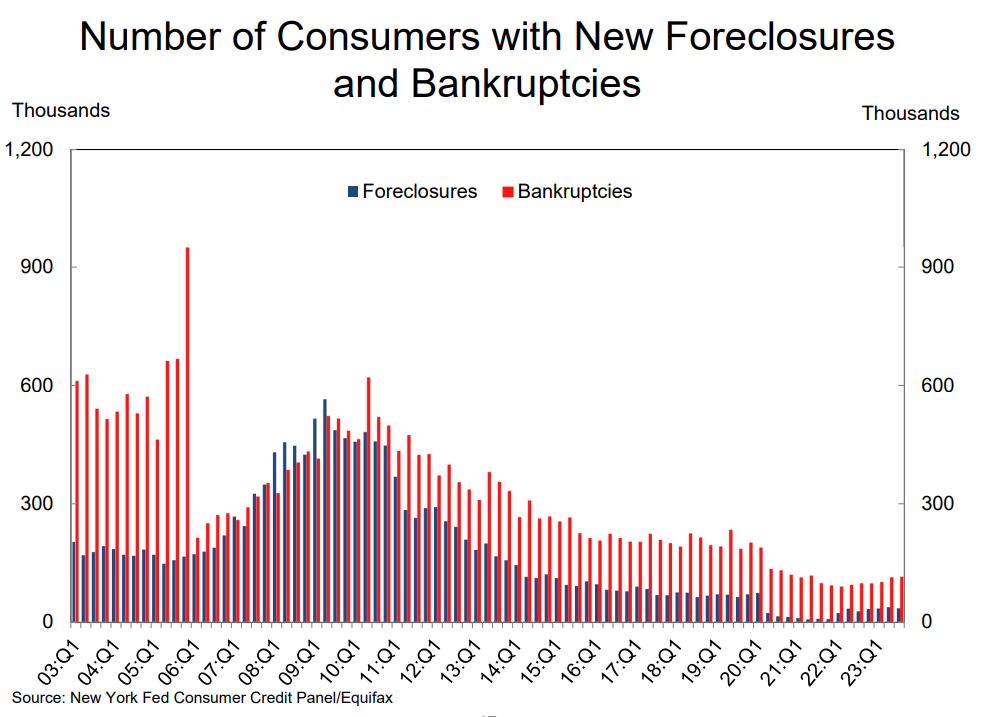

The identical is true of foreclosures and bankruptcies:

These readings would doubtless worsen in a recession, however we’re ranging from such a low baseline that we must go to a really dangerous place to significantly affect the housing market.

The housing market could gradual throughout a recession, however it’s not a assure.

Historical past says it’s truly extra possible housing costs gained’t fall through the subsequent recession.

We will see…

Additional Studying:

The Worst Case State of affairs for Housing

1These housing numbers are simply through the recession window. For instance, housing costs fell extra like 26%.

[ad_2]